Elections and Stocks

One of the investment questions we are repeatedly asked (especially during presidential election years) is how the upcoming election will affect my portfolio. What if (insert politician name here) wins? Should I completely rebalance my portfolio? Should I move into cash?

To that I say, I can only share with you the facts of how political elections affect markets.

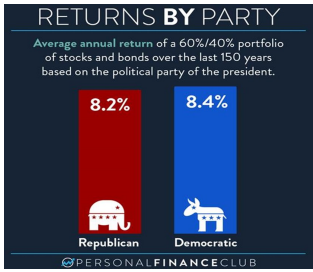

Over the last 100 years, stocks have averaged a 9-10% annual rate of return, with the political party in power making a statistically negligible difference. In fact, if you go back 150 years and look at a balanced 60/40 stock-to-bond portfolio, the returns during different political parties are essentially identical:

I’m reminded of the market’s response in the weeks following the 2016 and 2020 elections.

Depending on their side of the political aisle, many people were disappointed their candidate did not win and concerned with the potential impact on

their portfolios.

Following President Trump’s election in November 2016, the Dow Jones Industrial Average rallied over 5% through the end of the year. A similar trend

followed President Biden’s election in November 2020 with the Dow rallying nearly 10% through the end of the year. And, in fact, stocks would go on to do wonderfully under both presidents.

Yes, politics make for good theater, but it is paramount to divorce your politics from your portfolio. Stay invested.

As legendary investor Seth Klarman has stated: “The greatest single edge an investor can have is a long-term orientation.”

Leave the drama to the White House, not your investment portfolio.