A Strong Consumer & Economy Versus Intensifying Headwinds

The first quarter of 2022 was volatile for stocks. The S&P 500 Index fell 4.95%, the Dow Jones Industrial Average dropped 4.57%, and the MSCI All World ex USA Index was down 5.44%.

Bonds, always considered less volatile than stocks, actually declined more with the Barclays Aggregate Bond Index falling 5.93%.

Obviously, rising inflationary pressures combined with the Federal Reserve’s established intention to raise interest rates makes low-yielding bonds unattractive. Cash yields also remain paltry and are, in fact, losing money when factoring in current high inflation rates.

As such, we believe the durable dividend-paying equities we have positioned in your portfolio will probably be a better place for your money over the next three to five years.

It should be noted that stocks ended the quarter well off their lows reached in early March. We did, in fact, experience a correction last month, defined as a decline of 10% or more, as the S&P 500 Index at one point was down around 13% and the Nasdaq down almost 20%.

Your portfolio companies hung in well during the challenging first quarter as we maintain our longterm emphasis on disciplined, quality investing. Indeed, over the 24 months ending in last year’s third quarter, there had been a surge in speculative investments in unprofitable companies and other risky assets. As was the case in the fourth quarter of 2021, these speculative companies continued to get walloped in this year’s first quarter.

As longer-term investors, we view this popping of the speculative bubble as healthy for the financial markets. Furthermore, we believe investors will increasingly shift their positions to highly profitable businesses with pricing power, which, again, represents the foundation upon which we construct your investment portfolio.

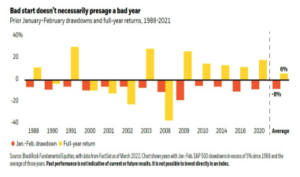

Historically, a poor start to a year does not necessarily translate into a bad full year for stocks. In fact, when stocks drop more than 5% during the first two months of the year, they usually rebound strongly, with a total average annual return of 6%.

Corporate fundamentals remain fantastic. Balance sheets are strong, cash flows are high, and earnings likely will continue to have solid growth here in the first quarter. In fact, with earnings season starting this week, it should be noted that in March there were minimal warnings of earnings shortfalls from U.S. corporations.

We expect your portfolio companies to grow their earnings at a higher rate than the market as a whole, while their valuations are essentially the same – offering a superior value, in our view. In challenging markets, investors traditionally focus on current earnings’ power and a company’s fundamental characteristics. Clearly, your portfolio companies exceed the average S&P 500 business by a wide margin in this regard.

While we face many macroeconomic concerns, the overall economy currently remains in solid shape. The jobs market has posted 11 straight months of job gains in excess of 400,000 and has a near record 11.3 million job openings. Unemployment continues to inch lower and currently hovers right around February’s 2020 pre-pandemic levels. Finally, the consumer remains healthy, even in this inflationary environment, with record amounts of cash and savings to be spent on goods and services.

So, on the whole, we remain constructive on equities for the full year of 2022 with pullbacks and corrections a part of the drama. Despite a deluge of negative news, stocks have been incredibly resilient; furthermore, there continues to be little competition for investment dollars, except perhaps in commodities, a very volatile asset class that can drop sharply at any hint of a recession.

However, as I mentioned in our last client letter, after three years of excellent stock market returns, there is more than a reasonable possibility that 2022 could be a tough one for equities. Again, as long-term investors, we don’t get caught up in year-to-year fluctuations in the market. As a wise investor once said: “If you are to succeed in investing, you have to take the good with the bad.”

You are all aware of the current headlines regarding the start of a rate hike cycle from the Federal Reserve, surging inflation levels, and Russia’s invasion of Ukraine. Let’s translate this into our views as it relates to your investment questions.

Q: Assuming the Russian-Ukraine war drags on for months, or longer, how will it impact the financial markets?

A: Let me start by stating the obvious but, nevertheless, most important fact: Russia’s invasion of Ukraine is a humanitarian tragedy on multiple levels and it is my sincere hope that Putin and his inner circle are held accountable for the atrocities committed.

The war is also a major economic concern. Russia and Ukraine export nearly 30% of the world’s corn and wheat and Russia is, of course, a major exporter of oil and gas.3 The disruptions in the global supply chain caused by this conflict are significant and are already trickling their way to the United States, primarily in the form of higher gas and food prices.

This is an inflationary event that if protracted, will have a very severe impact on parts of Europe and many emerging market countries. In fact, ironically, this situation could favor U.S. stocks, whose businesses are more insulated from the conflict than the rest of the world and viewed as a safe haven by many investors.

Remember, markets are always forward looking and likely have already priced in a prolonged RussiaUkraine war. If there is any hint of a ceasefire or progress with talks, which I think is the most likely outcome of this, then markets could rally powerfully. Keep in mind, both sides are “bleeding badly.” So, it is my hope that a ceasefire that holds could possibly happen by this time next year. Time will tell.

In the meantime, we are watching markets and your portfolio companies closely and making sure you have not only the highest quality companies, but are diversified in various industries to blunt any concentrated economic fallout as a result of these tragic events.

Q: Will the Federal Reserve increase interest rates too aggressively and lead us into a recession?

A: Interest rates are headed higher, because inflation is higher, and without question the Federal Reserve is behind the curve. Even I was saying to my investment team last summer – before the Ukraine war and the super spike in inflation – that the Fed should start to withdraw liquidity and begin gradually raising rates. But for some reason Powell refused to listen to me! LOL

So, the longer-term direction of interest rates and by extension inflation is anyone’s guess. Regardless, the strong U.S. economy gives some margin of safety in the face of rising interest rates.

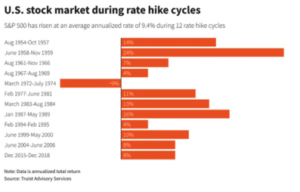

It is important to remember that rising interest rates are usually not a bad sign for stocks. In fact, in the last 11 of 12 rate hike cycles, stocks have performed very well, with an average return of over 9%, as the chart below illustrates.

We will continue to focus on positioning your portfolio in superb businesses, with “all-weather business models”; that is, companies with clear market leading positions, rising earnings and dividends and a consistent return on shareholder’s equity. Our emphasis on quality and diversified investing is designed to provide our clients with a buffer against economic and market downturns. Indeed, we believe the market’s conditions favor our investment approach more than ever, and we will continue to look for opportunities to prudently grow and preserve our client’s wealth over the long term.

Time and compound interest should take care of the rest.

As always, please do not hesitate to reach out to us if you have a change in your financial situation, investment goals, or income needs. We thank you for your continued confidence, and enjoy the spring!

Best Wishes,

James C. Burns, CFA President & Chief Investment Officer

You can also download this blog! First Quarter News Letter 2022